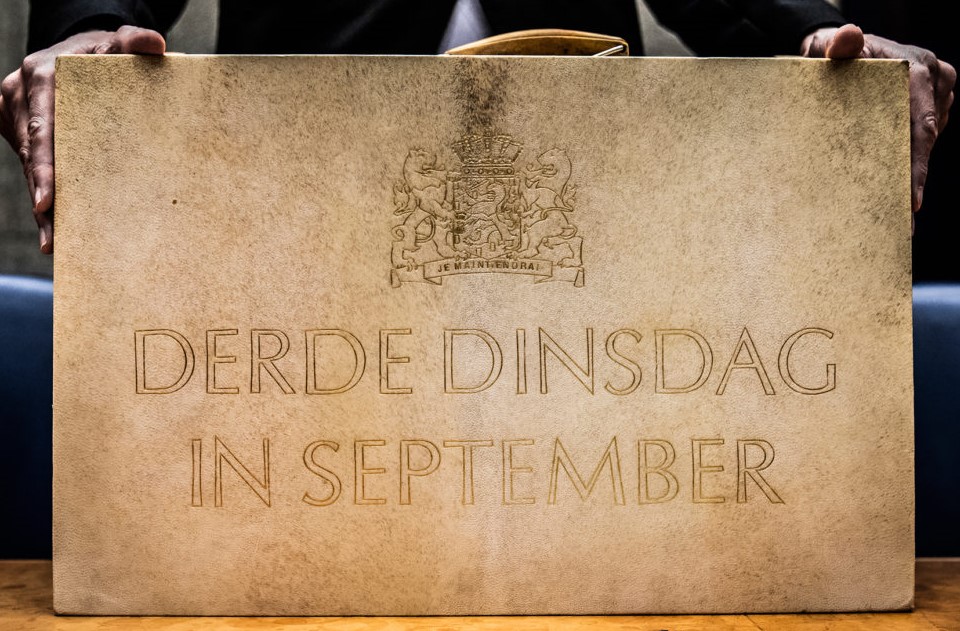

Dutch Tax Plan 2023

The Dutch government launches its tax plans for the coming year. We compiled a short summary of the most relevant tax measures that were introduced below.

Corporate income tax rate

The lower bracket of the corporate income tax rate will decrease to EUR 200,000 in 2023 (instead of EUR 395,000 in 2022). The tax rate in the first bracket will be increased from 15% to 19%. As a result, as of 2023, profits up to EUR 200,000 will be taxed at 19% and any excess profits will be taxed at 25.8%.

30% facility for inbound employees

The 30% facility, which consists of a monthly net-reimbursement that is meant to compensate extraterritorial costs for employees recruited abroad in the first five years of their employment, will be capped at a maximum salary. From 2024, the 30% ruling will be limited to an income up to the Balkenende Norm which is EUR 216,000 in 2022. The Balkenende Norm, is equal to 130 percent of what a minister in the Netherlands earns. A transitional arrangement applies to employees who were entitled to the 30% facility in the last payroll period of 2022. The cap will apply to these employees as of 2026.

Personal income tax

Workers that fall into the lowest tax bracket will see their income tax rate fall by 0.14 percentage points next year (i.e., 36.93% up to EUR 73,031, above 49.5%). As of 2024, the plan is to create a two-bracket system for income from substantial interest (5% or more) in a Dutch company at the level of the individual shareholder, now there is only one (26.9%). The intention is to tax this income up to EUR 67,000 at 24.5%; the amount that exceeds will be taxed at 31%. For non-Dutch tax residents the effect of this measure should be limited due to the application of the tax treaties.